Disclosure: This post may receive compensation from partners listed through affiliate partnerships, at no cost to you. This doesn’t influence our ratings, and the opinions are our own. Learn more here.

This is a complete guide to creating a personal net worth statement.

In this guide, you’ll learn:

So if you’re ready, let’s dive right in!

Bonus: Get a free net worth statement template below.

This net worth template will help you figure out how much you own/owe. Simply type in your own numbers and you will get an accurate figure of your financial situation.

A net worth statement gives you an idea of how much you are worth at any given point in time by subtracting whatever you owe (your debt) from what you own (your assets).

There are 3 ways your net worth could be summarized:

I want to note a point: Falling in the negative net worth category is OK. In fact, it’s pretty normal. Jumping from the negative net worth to the positive net worth is underrated, and should be celebrated in my opinion.

So let’s figure out how to notate a net worth in an actual formula.

Net Worth Defined: A net worth is a snapshot of your overall worth at a specific period in your life. Net worth = Assets – Liabilities

Below are the terms, above, defined:

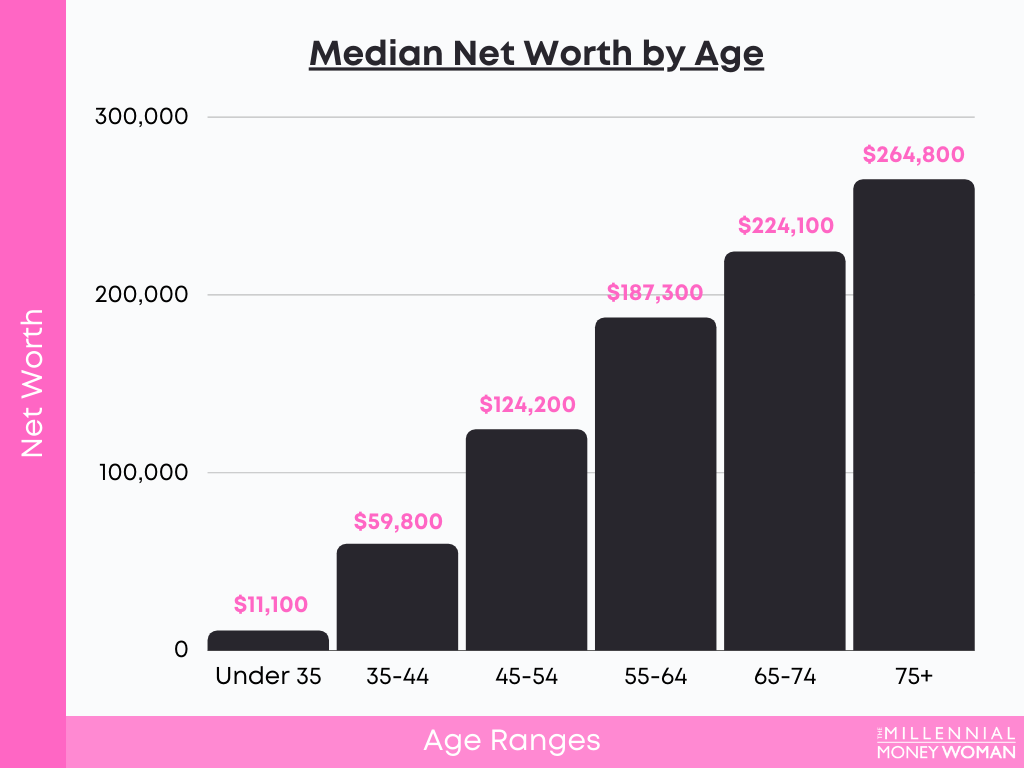

I’ve always been curious to see how my net worth at my current age compares to the rest of America.

If you’re like me, then I threw in a treat for you, below.

Check out the median (middle) net worth by age group in America.

The median American net worth sits around $97,300 .

As you can see, many people struggle to build a positive net worth for themselves – really at any age.

Especially for today’s millennials who have to deal with the stress of paying down student debt – building a positive net worth statement is not too easy and it takes time.

"The best way to jump out of a negative net worth situation is by starting - and sticking to - a budget."

So once you do cross over from a negative net worth statement to a positive net worth statement, I truly do think you should give yourself time to celebrate and enjoy this milestone

Understanding and knowing your net worth is very important.

Why would you prepare a net worth statement?

Honestly, the question should be: Why wouldn’t you want to prepare a net worth statement?

“A net worth statement can be brutal – but necessary - wake-up call and reality check.”

Benefits of a net worth statement:

Knowing where you currently are, financially speaking, can force you to be more thoughtful about how you spend your money.

Pro Tip: A fun exercise is to determine your net worth each year – perhaps every December for example. Track your net worth – and how it has changed over the years, and in a few decades, you’ll be very proud to see how [hopefully] you’ve increased your personal net worth statement.

That exercise is a fantastic way to feel good about yourself – especially when you see the hard work that you’ve put into paying down debt and amassing more assets.

Keep in mind that we’ll be looking into how we can prepare a personal net worth statement.

However, business net worth statements are fairly similar in style and manner compared to a personal net worth statement.

Below are the 4 simple steps to creating an accurate net worth statement:

Now, keep in mind that finding your net worth is based on a proven formula.

Net worth = Assets – Liabilities

Now, what if you are not sure what an asset or liability actually is.

Let me provide some examples, below.

Cash in bank accounts Bank statement Investment accounts Monthly investment account statement Retirement accounts (IRAs, Roth IRAs, 401(k)s, 403(b)s, etc.)Monthly retirement account statement – if you have trouble finding this document, contact your HR representative

Home equityTypically your home’s equity is calculated using the following formula: Equity = Current Home Market Value – Outstanding Mortgage (which is found on your monthly mortgage statement)

Similar to finding your home equity, find out how much your car is currently worth (using resources such as the Kelly Blue Book) and subtract what you owe (if anything), found on your monthly auto loan bill

Cash value in life insuranceYou’ll typically find the net cash value of a life insurance policy in your monthly insurance statement

HSA assets (health savings account) You’ll find this value in your monthly HSA statement Art, jewelry, collectibles Typically you would want an appraiser to help you find the current market value of these items Accounts receivableAnything that is still owed to you (if you own a business for example) but you have not yet received payment is also considered an asset

Now let’s take a look at some examples of liabilities (what you owe) and where you can find the information to help you determine the amount of money that you owe.

This is what you owe on your home. You’ll likely find your mortgage on your monthly statement Credit card billsYou’ll have to download the most recent monthly credit card statement (typically found online) to see your current balance that’s owed

Auto loans The amount you owe on a car is typically noted in your monthly auto loan bill Student debtAny federal, private, subsidized or unsubsidized student loan is considered a debt. You’ll find the value of this student loan on the latest monthly statement

Accounts payableIf you owe money and have not yet paid to what is typically a business, this is considered to be an “account payable.” An example of an account payable could be an unpaid medical bill

Loans of life insurance policiesIf you have taken out a loan on a life insurance policy (which I do not recommend), you’ll find the information on your latest monthly life insurance statement

Unpaid income taxIf you still owe income taxes, consider this expense to be a liability. You’ll likely find this amount by calling your accountant or CPA – or you would see this information in your latest tax return

Make sure you carefully analyze your current debts so that you net worth statement is as accurate as possible.

Pro Tip: Make sure you are honest with yourself as you evaluate your current financial situation.It would be pretty bad if you try to skip over some debts or inflate what you currently own just to make your net worth statement look better.

Don’t do it. You’re going to regret that later.

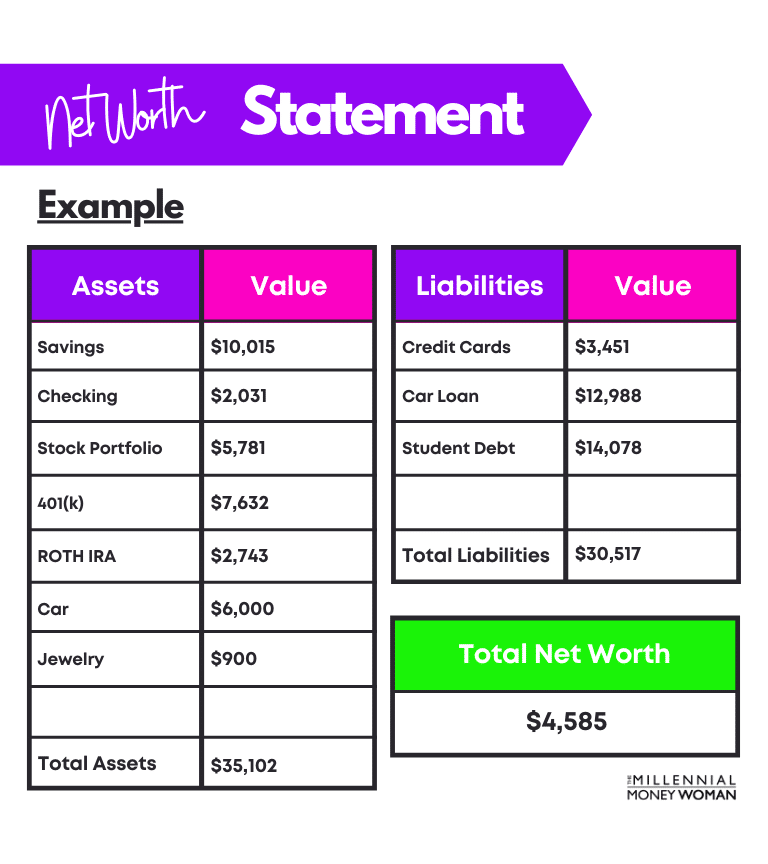

If you’ve just downloaded my free net worth statement template but aren’t quite sure on where to start – or really how to start, I’ve prepared an example net worth statement, below.

Actually, I’ve obtained the permission from one of my mentees to share her current net worth.

[Hint: She’s super proud about her recent net worth statement accomplishment and asked me to share this to the world].

Pro Tip: My mentee accomplished a major milestone: For the first time in her life, her net worth turned positive. Just like my mentee’s accomplishment, you too should celebrate big milestones.

Before we take a look at her net worth, let’s check out some of her statistics, so her net worth statement numbers make more sense:

Marital status Public relations expert Annual salary Miami, Florida Highest college level Undergraduate degree Student debt - after graduation $97,000 (private college)Now that we’ve figured out my mentee’s basic information, let’s take a deep dive into her net worth.

Although my mentee might not be a millionaire (yet) – she has worked long and hard to dig her way out of debt (at one point, she was saddled with more than $110,000 of debt).

This debt included:

Thanks to tracking her net worth – and thanks to consistently sticking to her plan to pay down her outstanding debt balance – she achieved her goal: A positive net worth balance.

If she can do it, you can, too.

Now you know the following:

Well, what are you waiting for?

If you haven’t tried to construct your personal net worth statement yet, do it now.

It might take you some time if you are a newbie, but trust me, going through the process of finding the documents to piece together your net worth statement is actually pretty fun (believe it or not).

Because it will help you better understand:

What if you are nervous and don’t want to find out how much you are worth (ie – you don’t want to find out that your net worth is -$100,000 – which is actually not too unusual)?

“Ignorance is not always bliss when it comes to your net worth.”

I think if you’re nervous now to find out your true net worth number, if you wait a few more years to then determine your personal net worth statement – you’ll likely have small heart palpitations.

Bottom Line: Don’t wait to find out your net worth. Do it now.

Your bank accounts will thank me later!

How has your net worth increased (or decreased) over the years?